idaho sales tax rate 2020

The December 2020 total local sales tax rate was also 6000. The minimum combined 2022 sales tax rate for Boise Idaho is 6.

An alternative sales tax rate of 6 applies in the tax region Canyon which appertains to zip codes 83651.

. Prescription Drugs are exempt from the Idaho sales tax. 2021 Idaho Sales Tax Table. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

Plus 6625 of the amount over. For tax rates in other cities see Idaho sales taxes by city and county. At Least But Less Than Single or Married Filing Separately Married Filing Jointly or Head of Household 25350 25400 25450 Your tax is 25300 25350 25400 1483 1487 1490 1213 1216 1220 If Form 40 line 19 or Form 43 line 41 is.

Printable PDF Idaho Sales Tax Datasheet. Also some Idaho residents will receive a one-time tax rebate in 2021. The current total local sales tax rate in Boise ID is 6000.

Year Annual Monthly Daily. The maximum local tax rate. Idaho has state sales.

The minimum combined 2022 sales tax rate for Idaho Falls Idaho is. This is the total of state county and city sales tax rates. The corporate income tax rate is now 65.

Idaho has recent rate changes Fri Jan 01 2021. This means that Idaho taxes higher earnings at a higher rate. House Bill 380 Effective January 1 2021.

Download our Idaho sales tax database. The County sales tax rate is 0. Plus 3125 of the amount over.

Plus 4625 of the amount over. For individual income tax rates now range from 1 to 65 and the number of tax brackets dropped from seven to five. And filing status column meet is 1216.

Ad Lookup Sales Tax Rates For Free. What is the sales tax rate in Idaho Falls Idaho. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

Select the Idaho city from the list of popular cities below to see its current sales tax rate. This is the total of state county and city sales tax rates. Average Sales Tax With Local.

Individual income tax is graduated. The County sales tax rate is. Idaho Code Title 63.

Tax Rate. 2020 rates included for use while preparing your income tax deduction. Plus 5625 of the amount over.

Interactive Tax Map Unlimited Use. This is the total of state county and city sales tax rates. This means that depending on your location within Idaho the total tax you pay can be significantly higher than the 6 state sales tax.

Wayfair Inc affect Idaho. The Boise sales tax rate is 0. With local taxes the total sales tax rate is between 6000 and 8500.

2022 Idaho Sales Tax Table. Boise ID Sales Tax Rate. 31 rows Idaho ID Sales Tax Rates by City.

Keep copies of your tax returns and all supporting documentation for at least seven years. The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your. Learn more about Idaho individual income tax.

An alternative sales tax rate of 6 applies in the tax region Ada which appertains to zip codes 83686 and 83687. Plus 3625 of the amount over. The 6 sales tax rate in Boise consists of 6 Idaho state sales tax.

Municipal governments in Idaho are also allowed to collect a local-option sales tax that ranges from 0 to 3 across the state with an average local tax of 0074 for a total of 6074 when combined with the state sales tax. 2020 Idaho State Sales Tax Rates The list below details the localities in Idaho with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. The Idaho Falls sales tax rate is.

Chart of interest annual interest rate beginning in 1981. There is no applicable county tax city tax or special tax. Income tax rates range from 1 to 65 on Idaho taxable income.

The state sales tax rate in Idaho is 6000. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85. The Idaho sales tax rate is currently.

Idaho has a statewide sales tax rate of 6 which has been in place since 1965. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Idaho has a 6 statewide sales tax rate but also has 112 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0074 on top of the state tax.

The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your. Did South Dakota v. You can print a 6 sales tax table here.

The Nampa Idaho sales tax rate of 6 applies to the following four zip codes. 270 rows Idaho Sales Tax. Idaho has a 6 sales tax and Kootenai County collects an additional NA so the minimum sales tax rate in Kootenai County is 6 not including any city or special district taxes.

The Idaho sales tax rate is currently 6. Idahos income tax rates have been reduced. Plus 1125 of the amount over.

This is the tax amount they must write on Form 40 line 20 or Form 43 line 42. The Twin Falls Idaho sales tax is 600 the. The sales tax jurisdiction name is Boise Auditorium District Sp which may refer to a local government division.

83651 83653 83686 and 83687.

States With Highest And Lowest Sales Tax Rates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Idaho State Income Tax Refund Status Id State Tax Brackets

U S Sales Taxes By State 2020 U S Tax Vatglobal

Idaho Sales Tax Small Business Guide Truic

Idaho House Passes 600 Million Income Tax Cut And Tax Rebate Bill Idaho Capital Sun

Historical Idaho Tax Policy Information Ballotpedia

Change To Idaho Sales Tax Formula Impacts Boise Other Cities

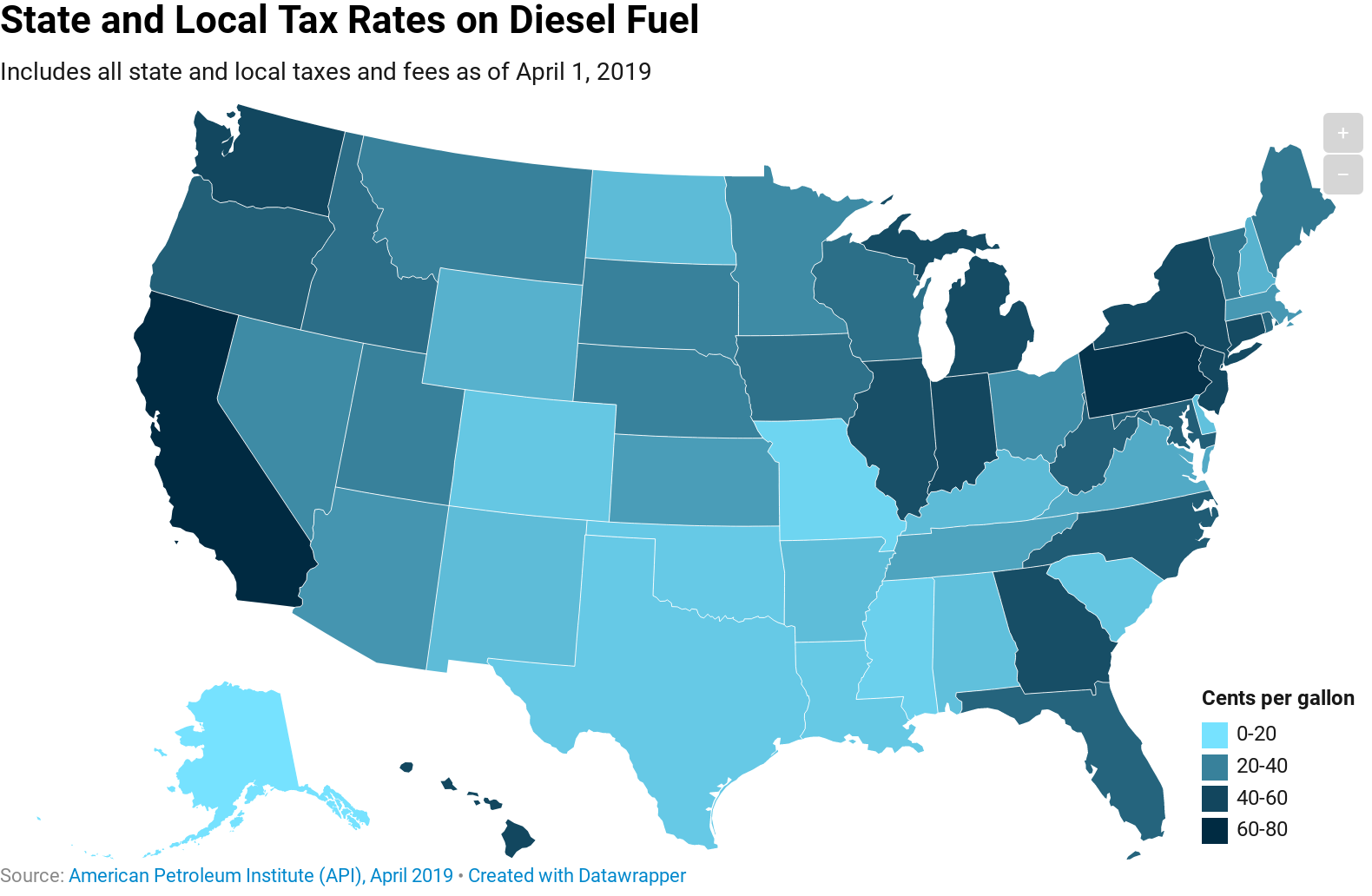

Gas Tax By State 2020 Current State Diesel Motor Fuel Tax Rates

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Idaho Offers Residents A Grocery Sales Tax Credit Taxjar